The Agency/Marketer Chasm: Non-Marketing Spending

We’re creating a series of posts around our recent report, The RSW 2023 New Year Outlook, (which you can download here at no cost), with a focus on non-marketing spending to kick things off.

We’ve been releasing this report for well over a decade, and the goal is to provide small and mid-sized agencies and PR firms of all types with a series of guideposts entering the New Year, primarily to help prepare from a new business standpoint.

In a series of posts, we’ll hit the key stats and provide some perspective around each.

First, we look at the following question we asked agencies and marketers in our survey:

How would you characterize the most likely investment action YOUR marketing agency will take in 2023 (for NON-marketing activities like people, equipment, and technology)?

The Agency/Marketer Chasm: Non-Marketing Spending

In last year’s report, we saw two disheartening situations:

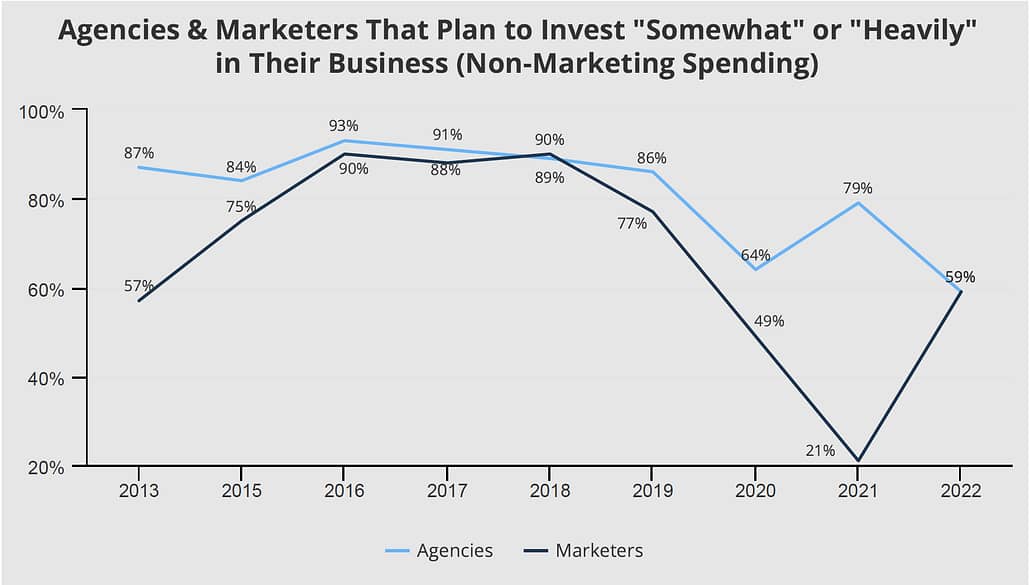

1) Just when we thought marketer enthusiasm couldn’t drop any lower (than we saw in 2020), in 2021 it went even lower, with only 21% of marketers saying they would “somewhat” or “significantly” increase spending on non-marketing activities as they roll into the new year.

2) We saw a stark contrast in the respective temperaments of marketers and agencies.

In 2020 agency enthusiasm for spending took a dive, with only 64% of agencies indicating they would be spending at higher levels for non-marketing the following year, but last year was a different story, with 79% of agencies reporting they planned to “somewhat” or “heavily” invest in non-marketing activities.

Moving into 2023, however, we see a strange synergy that we haven’t seen in this report since 2018:

59% of agencies and marketers said they would invest somewhat to heavily in their business (non-marketing spending).

Marketers Are, Apparently, Optimistic-Agencies, Not So Much

So that’s a 38-point increase for marketers, which is positive given the strange economic climate we’re in!

Agencies-time to kick new business into gear with that kind of increase, right?

Well, it’s not all roses.

On the agency side, we’re looking at a 20-point decrease in agency investment expectations from 2021!

What does it mean?

Explaining Both Sides Of The Chasm

Non-Marketing activities on both sides encompass investment in new hires, technology, R&D, and travel, for example.

After falling to basement levels over the past few years, this 38-point increase in investment on the marketer side would seem to be a course correction, for lack of a better word.

After several years of uncertainty, it simply wasn’t a positive trend for business viability and healthy growth to continually decrease investment levels.

So, there’s positive potential here for agencies in the form of stronger pipelines of new product and service

launches for marketers, which would impact their agencies’ ability to drive more organic growth.

Turning to agencies, with investment intention at an all-time high last year, it would seem they are also expecting a course correction.

59% is still a healthy number, but agencies need to be careful.

You’ll see as you delve into our report, there are many reasons for agencies to be optimistic, for example, in-house trends are favorable to agencies, as is the perception that agencies are on top of trends.

On the flip side, our report also explores the top reasons why marketers start new reviews, playing into the need for continued investment in agency non-marketing spending.

Of course there’s a bottom-line that can never be ignored, but agencies need to be careful not to pull back too much on this type of investment.

The pull-back on non-marketing investment does make some sense, and a certain level of caution on the agency side is warranted, but along with taking precautionary steps based on the economy, agencies can’t ignore the need for an ongoing new business, organic growth, and client retention plan.

One thing we saw affecting small and mid-sized agencies in the back half of 2022 was an overall slowdown in ongoing client-work, it took a lot longer to get projects going, or started.

As part of client growth and retention strategy, agencies must specifically convey investments they’re making in the business, to both their clients, and in their prospecting, to show they’re ahead of the curve.